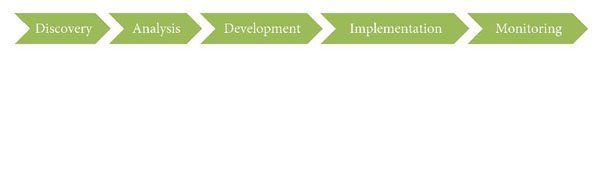

Our Process

We have a clearly defined financial planning process with five key steps.

1. Discovery: During our first consultation, our primary objective is to become familiar with your life and discover what is important to you, financially and personally. We take those ideas and formulate distinct goals, identifying what you want to accomplish with your money.

2. Analysis: After developing specific goals, we analyze your current financial situation, including evaluating your total wealth and investment history. Our thorough overview of your finances allows us to more accurately plan for your financial well-being.

3. Development: Once we finish analyzing your personal financial situation, we compile the information gathered and compare it with your goals. The components of your customized comprehensive plan are chosen based on our findings. Each plan is individually suited to the client, for each client has a different set of circumstances concerning the creation of their plan.

4. Implementation: We meet with you to discuss your completed financial plan. We explain everything in an easy to understand manner, so you know how your money is working for you. We implement this plan and coordinate the process with you, our team, and your other trusted professionals.

5. Monitoring: We continually monitor your plan and review it regularly to help keep your mind at ease. Changes are suggested as appropriate and we will work with you to revise the plan as your goals change.

Marketplace Financial Group, LLC

109 East Bell Street

Neenah, Wisconsin 54956

Phone: (920) 886-0220

Fax: (920) 886-0217

Schedule a call or meeting with Karl

Schedule a call or meeting with Lisa

Products and services offered

- Financial planning

- Life insurance

- Disability insurance

- Long term care insurance

- Retirement planning

- Education funding strategies

- Group benefits

- 401(k) and profit sharing plans

- Deferred compensation programs

- Key employee insurance

- Key employee financial strategies

- Buy sell design & implementation

Registered Representative, Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Marketplace Financial Group, LLC are not affiliated.

This communication is strictly intended for individuals residing in the states of AZ, CA, FL, GA, IA, IL, IN, KS, MI, MN, MT, NC, OH, OR, PA, TX, UT, WA, WI. No offers may be made or accepted from any resident outside the specific states referenced.

The information being provided is strictly as a courtesy. When you link to any of these web-sites provided herein, Marketplace Financial Group, LLC makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information and programs made available through this site.